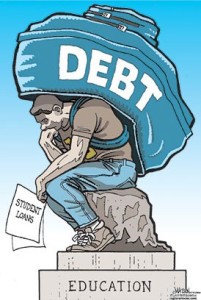

Courtesy of www.jhartfound.org

By: JANAY HUNT

College graduates owe about an average of $26,000, finding affordable education goes on. The tuitions get higher and interest in student loans pile up, there is help out there that many do not know about. Student loan debt has left Americans owing more than $900 billion collectively.

The programs out there to help students who cannot afford their monthly student loans Pay As You Earn (PAYE) and Income-Based Repayment (IBR). Besides the more well-known loan-forgiveness programs available mostly to teachers, government employees, and volunteers and others with service-based jobs, PAYE and IBR are both income-based and designed to help anyone without a lot of money pay down their student loan debt by capping monthly payments to make them more affordable.

Both repayment programs can be hard to decode, the government looks at a person’s debt-to-income ratio, and if what is owed is higher in relation to what is earned, the government may assist in payments. PAYE, which is available only to new borrowers who took out federal direct loans caps monthly loan payments for a former students at 10 percent of their flexible income for 20 years. If any debt remains after the time period, it is forgiven. IBR is easier to qualify for, but borrowers pay 15 percent of their flexible income for a 25 year period.

Leave a Reply